ULIPs present life insurance plan protection coupled with investment Advantages. Inside the party of your policyholder's untimely demise, the nominee gets the sum assured or perhaps the fund benefit, whichever is increased.

While each treatment continues to be taken in the planning of the written content, it really is subject matter to correction and marketplaces might not conduct in an analogous vogue according to variables influencing the cash and personal debt markets; that's why this ad would not individually confer any legal rights or duties.

The varied resources provided beneath this deal will be the names on the cash and don't in almost any way suggest the caliber of these plans, their upcoming prospects and returns. On survival to the top from the plan phrase, the whole Fund Benefit which include Prime-Up Premium Fund Worth valued at relevant NAV on the day of Maturity are going to be paid.

Remember to tick the Test box to proceed Nearly there! Your top quality calculation is in progress

Investments are issue to market place hazards. The Company won't ensure any confident returns. The investment cash flow and cost may well go down along with up depending on many elements influencing the marketplace.

In ULIP, a portion of the top quality paid out through the policyholder is utilized for daily life insurance plan protection, even though the remaining volume is invested in several equity, financial debt or balanced resources According to the policyholder's preference.

ULIPs provide the flexibility of selecting involving diverse money according to the policyholder's hazard hunger and share current market investment targets. The policyholder can switch involving distinct cash as per their economical ambitions and marketplace disorders.

Relevant for department stroll in. Deadline to post assert to Tata AIA by two pm (Doing the job times). Subject matter to submission of full files. Not applicable to ULIP procedures and open up title claims.

Tata AIA Vitality$$ is usually a globally acknowledged, holistic and science-dependent wellness plan that can help you have an understanding of and boost your health and fitness whilst also fulfilling you. The benefits may very well be in the form of Price cut on High quality, Cover Booster and so forth.

The objective of the Fund would be to create funds appreciation in the long run by purchasing a diversified portfolio of companies which might read benefit from India’s Domestic Consumption development story.

and AIA Firm Minimal. The evaluation beneath the wellness software shall not be regarded as a health care assistance or a substitute into a session/remedy by knowledgeable health-related practitioner.

Good and Service tax and Cess, if any is going to be billed excess as per find here prevailing rates. The Tax-Cost-free money is matter to conditions specified beneath section 10(10D) and various applicable provisions on the Cash flow Tax Act,1961. Tax legislation are subject to amendments created thereto occasionally. Please consult your tax advisor for specifics, in advance of performing on higher than.

The overall performance in the managed portfolios and money is just not certain, and the value could enhance or lower in accordance with the long run knowledge on the managed portfolios and money.

Tata AIA Param Raksha Life Professional + is a comprehensive lifetime insurance policy Answer featuring thorough protection together with wealth generation Rewards. It offers flexible choices for securing All your family members’s foreseeable future while maximizing fiscal growth by way of market connected returns$.

4All Premiums in the plan are exceptional of applicable taxes, obligations, surcharge, cesses or levies that may be totally borne/ paid by the Policyholder, In combination with the payment of these Top quality.

ULIP means Unit Joined Insurance plan Program, which is a style of insurance policy products that combines the advantages of lifetime insurance coverage and investment in one strategy.

The maturity reward presented less than this plan is the entire fund worth of your investment at 4% or 8%, as maturity7 total including loyalty additions along with other refundable fees, together with the return of many of the rates compensated to the Tata AIA Vitality Secure Progress lifestyle insurance plan plan.

These solutions are obtainable for sale independently with no The mixture supplied/ advised. This advantage illustration will be the arithmetic combination and chronological listing of put together great things about specific products.

Alicia Silverstone Then & Now!

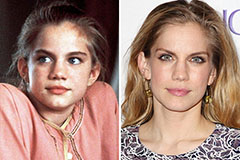

Alicia Silverstone Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Lacey Chabert Then & Now!

Lacey Chabert Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!